Since there are lots of things that could hurt your own credit, you might be thinking about if it’s the loan does. At a glimpse, loans and how you manage them determine the score that you are going to have. Since credit calculation versions are usually complex, loans may either tank or boost your credit rating. If you don’t make timely payments, taking out a loan would be as good as tanking your credit rating. Your credit report is a snapshot that lenders use to determine whether or not you are creditworthy. There’s some speculation around the essence of the check since you want a loan to build a background. When you loved this post and you would love to receive much more information concerning pop over to this web-site i implore you to visit our own page. Since you require a loan to build a fantastic history, your probability of success might be rather minimal. To be qualified for a new loan, you are going to need a good history and utilization ration to be eligible for credit. If you have cleared your invoices early in the past, they might think about you a creditworthy consumer. If you continuously make overdue payments, potential lenders will question your loan eligibility. Applying to get a new loan might allow you to fix a severely broken credit. Since the amount of debt takes a huge chunk of your report (30%), you should pay utmost attention to it.

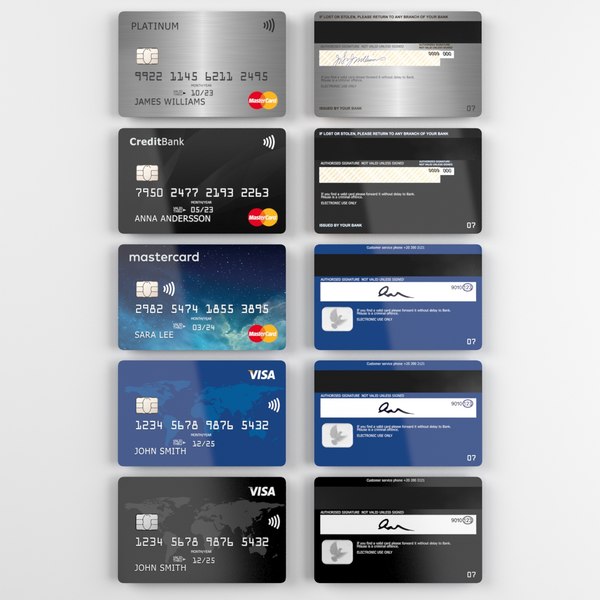

Getting a traditional loan or line of credit could be daunting if you’ve got bad credit. Although a loan is what you need to construct your own credit, such a circumstance is certainly counterintuitive. However, the excellent news is you can find a secured credit card with bad credit. Some lenders could be more willing to issue credit cards to consumers even if they have zero history. Primarily, you ought to secure a deposit which would be deducted if you are not able to clean the balance. Card issuers collect basic identification data and financial information from the card candidates. After granting the issuer permission for a soft query, you’re initiate the transaction to get the deposit. In some scenarios, you are going to supply account information to the issuer to debit the amount directly. Of course, secured credit cards possess a huge difference from the traditional cards. Secured credit cards possess some comparative downsides to an unsecured card.

Without a doubt, many items can affect your credit report and tank your own score. In a glimpse, credit fix is all about fixing your credit by eliminating the negative items. In some cases, it might only entail disputing the unwanted entries with the respective bureaus. If this scenario happens to you, you may have to engage a credit repair firm. That is only because you’ll surely have a run of legal hoops to maneuver through and fix complexities. Fraud and identity theft involves well-connected criminal activities; you are going to require a repair company. Unsurprisingly, unraveling the series of these chains can prove useless if you do it on your own. Even though you can complete the process on your own, a credit repair company may be ideal. Without a doubt, several credit repair processes entail complex phases you’ll need to go through. In whichever situation, involving a fix business or working on your own may be fruitful.

Without a doubt, many items can affect your credit report and tank your own score. In a glimpse, credit fix is all about fixing your credit by eliminating the negative items. In some cases, it might only entail disputing the unwanted entries with the respective bureaus. If this scenario happens to you, you may have to engage a credit repair firm. That is only because you’ll surely have a run of legal hoops to maneuver through and fix complexities. Fraud and identity theft involves well-connected criminal activities; you are going to require a repair company. Unsurprisingly, unraveling the series of these chains can prove useless if you do it on your own. Even though you can complete the process on your own, a credit repair company may be ideal. Without a doubt, several credit repair processes entail complex phases you’ll need to go through. In whichever situation, involving a fix business or working on your own may be fruitful.

Round the US, using a credit card continues being one of the most efficient financial tools. Countless consumer stories point towards going through enormous hurdles to obtaining one. Naturally, a charge card has its related advantages and a couple of disadvantages too. During program, credit card issuers appear at many metrics before entrusting your own card software. In other words, obtaining a very low credit score would almost guarantee a flopped application. You will need to take into account your spending habits, usage, and obligations after getting the card. If you go beyond the 30% credit usage limitation, your credit rating will undoubtedly drop. Besides, sending your application authorizes the issuer to perform a tough inquiry which affects your score. The further you have unsuccessful applications, the more questions you are going to have in your report. In regards to utilizing the card, many exemptions adhere to high frequency standards. Failure to obey the regulations would tank your credit score and harm your report.

Round the US, using a credit card continues being one of the most efficient financial tools. Countless consumer stories point towards going through enormous hurdles to obtaining one. Naturally, a charge card has its related advantages and a couple of disadvantages too. During program, credit card issuers appear at many metrics before entrusting your own card software. In other words, obtaining a very low credit score would almost guarantee a flopped application. You will need to take into account your spending habits, usage, and obligations after getting the card. If you go beyond the 30% credit usage limitation, your credit rating will undoubtedly drop. Besides, sending your application authorizes the issuer to perform a tough inquiry which affects your score. The further you have unsuccessful applications, the more questions you are going to have in your report. In regards to utilizing the card, many exemptions adhere to high frequency standards. Failure to obey the regulations would tank your credit score and harm your report.

Based on the FCRA’s provisions, it is possible to retrieve and dispute any negative information in your report. In essence, the responsible information center has to delete the information if it can’t confirm it as legitimate. Like any other entity, credit information centers are prone to making lots of mistakes, particularly in a credit report. The FCRA asserts that near one in every five Americans have mistakes in their reports. Your credit report is directly proportional to your own score, which means that a bad report could hurt you. Because your score informs the kind of consumer you’re, you need to place heavy emphasis on it. Several loan applicants have experienced an ineffective program due to a bad credit score. Having said that, you should operate to delete the harmful entries from your credit report. Late payments, bankruptcies, challenging inquiries, paid collections, and deceptive activity can impact you. Detrimental entrances can tank your credit rating; hence you need to attempt to eliminate all of them. Besides removing the entries by yourself, among the very best ways is using a repair firm. Since this procedure involves a lot of specialized and legalities, most men and women opt for credit score having a repair company. In this piece, we’ve compiled a detailed series of steps on what you want to learn about credit repair.